First, what exactly is a cancelled check?

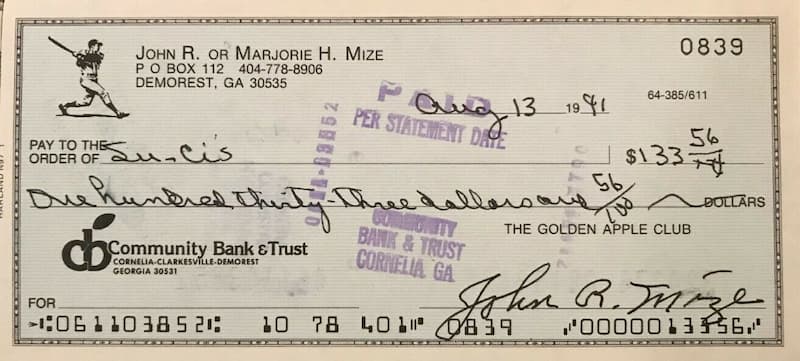

A cancelled check is a check that has been paid or cleared by the bank it was drawn on after it has been deposited or cashed. Once a check is cashed or used, it is “cancelled,” making it impossible for it to be used again.

A check may be cancelled after it has been written by notifying the issuing bank, which will void the check before it is deposited or chased.

Please continue reading for more information.

Table of Contents

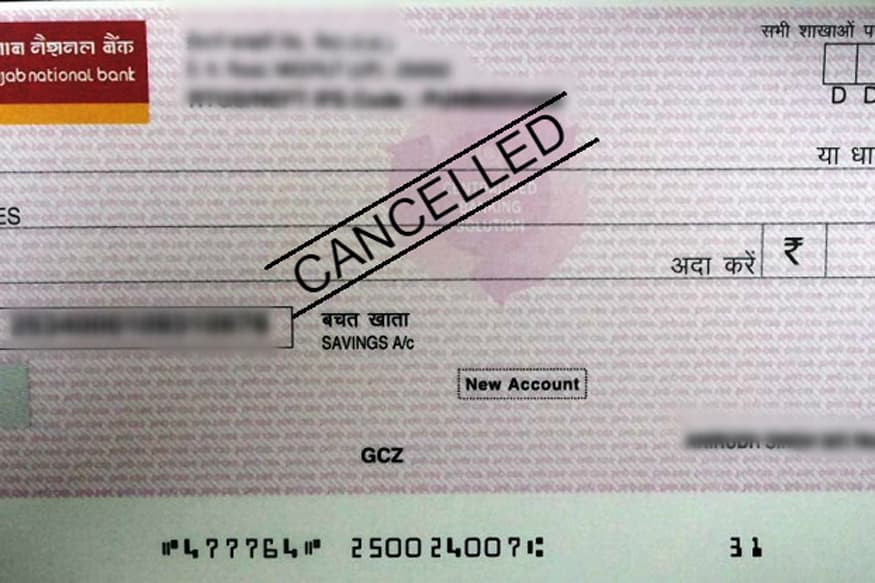

A Cancelled Cheque

A cancelled check is one that has been crossed over twice and has the word “cancelled” written across it. A cheque maybe cancelled if any mistakes have been made while writing the cheque and that is why it is known as a cancelled cheque, but there is no need that anything else is mentioned on a cheque other than the word “cancelled”. Usually, it is cancelled to prevent the check from being used improperly by anyone.

To demonstrate that a person has a bank account, a cancelled check is acceptable. In addition, even though a cancelled cheque cannot be used to withdraw money from the account of the drawer, it contains other details such as the name of the account holder, account number of the drawer, MICR code, IFSC Code, name and branch of the address in which the account exists, and the cheque number.

Uses Of A Cancelled Cheque

Although you cannot withdraw cash with a cancelled check, there are still a few things you can do with it. A few uses for a cancelled check include:

- Know Your Customer (KYC) – Cancelled cheques are helpful for various KYC procedures when investing in mutual funds or the stock market because they contain important details like the proof that the person in question has an account in a bank, their name and account number, and the name and branch address of the bank where they have an account.

- EQUATED MONTHLY INSTALLMENTS (EMI) – EMI options are available for a variety of loans, including home loans, education loans, car loans, and others. To complete the necessary steps to assign such monthly payment methods, the bank or company in question would need a cancelled check.

- DEMAT ACCOUNT – A cancelled check, a form for opening an account, and additional KYC documents, such as a proof of identity or proof of address, are required when opening a demat account, which is used by individuals to hold shares in electronic form. need to be submitted to the stock brokerage.

- ELECTRONIC CLEARANCE SERVICE (ECS) – Money can be transferred between bank accounts electronically using the ECS method. Every month, money would be taken out of your account if you set up an ECS from your account. The bank would need a cancelled check from you in order to make this deduction.

- WITHDRAWAL OF EMPLOYEE PROVIDENT FUND (EPF) – In order to verify the account information of the person making the withdrawal from the EPF, a cancelled check is needed to be submitted.

- OPENING A BANK ACCOUNT – A voided check must be provided when opening a bank account in order for the process to be finished.

- INSURANCE POLICIES– Some businesses request a cancelled check from the person choosing an insurance policy in order to purchase one.

What Makes A Copy Of A Cancelled Check Necessary?

A cancelled check may be necessary in a number of circumstances, such as when you want to challenge a bank account withdrawal or provide transaction history proof. Here are a few typical problems that you might experience.

- Disputing an error with your bank — For instance, you might have cashed a check or paid someone with one, but neither party can locate a record of the transaction.

- Providing a receipt of charitable donations — A copy of your cancelled check may be required as additional documentation at tax time in addition to a letter or receipt.

- Proof of making a tax payment — A voided check could be used as evidence if the Internal Revenue Service does not have a record of your payment. A copy of the cancelled check could support your claim if two weeks have passed since you mailed your tax check and it has still not been acknowledged.

- Resolving payment issues between companies or banks — A cancelled check or monthly statement mentioning the check can demonstrate payment was made in the event that someone claims they were not paid from your check.

How Customer Access To Cancelled Checks Works

In the past, cancelled checks were delivered to account holders along with monthly statements. Nowadays, this is uncommon, and the majority of check writers receive scanned copies of their cancelled checks from the banks, who also make digital copies for storage.

Financial institutions are required by law to keep cancelled checks for a period of seven years or the ability to make copies of them. The majority of the time, customers who use online banking can access copies of their cancelled checks online. Customers can typically print copies from the bank’s website for no cost, even though many banks charge for paper copies of cancelled checks.

Cancelled Check Fees

While there are no fees associated with cancelled checks themselves, there may be charges associated with ordering copies of them from your bank. For example, Bank of America doesn’t charge for the first two check copies of each request, but then it charges $3 for each copy up to $75 per request.4 By viewing and printing cancelled checks online, you can frequently avoid these fees, which vary by institution.

How To Write A Cancelled Check?

It’s crucial to cancel a check because misuse of checks is common. If you are cancelling a cheque to submit it for a particular purpose, the following steps should be followed:

Step 1: Remove the original check that you want to cancel and replace it. On the check, do not sign anywhere.

Step 2: Cross the check with two parallel lines that are parallel to one another.

Step 3: In between those two lines, capitalize “CANCELLED.”

The parallel lines that you draw across the check must not cover any crucial information, including the account number, the name of the account holder, the IFSC code, the MIRC code, the name and branch address of the bank where the account is held, etc.

You can start at step 2 of the procedure described above if you need to cancel a check due to a mistake you may have made in the check.

Even though a cancelled check cannot be cashed, many fraudulent activities can still take place with its use. To be on the safe side, make sure that you do not sign any cancelled checks that you give out and that they are given to the correct person who will be collecting them. See more about What Is A Cashtag?

Cancelled Checks Vs. Returned Checks

A returned check is one that did not clear the payor’s bank, so the funds would not be made available to the payee or the depositor. In contrast to cancelled checks, which are honored by banks, returned checks are not. Insufficient funds in the payor’s account is one of a few possible causes for which a check may be marked as returned.

The check may nevertheless be returned for additional reasons, such as:

- The check was written more than six months ago from the date it was issued.

- The payor’s account has been terminated.

- The author of the check lacks the necessary signing privileges to issue checks on the account.

- On the check, a stop payment order was issued.

The bank may return a check to the payee if there is not sufficient funds in the account to cover it. The payor’s bank typically assesses a fee to the payor’s account for writing a check that ultimately bounced due to insufficient funds, and the payee’s bank typically assesses a fee to the payee.

Cancelled Check Vs. Stop Payment Order

A stop payment and a voided check are not the same thing, despite their similarity in sound. A stop payment order typically prevents a bank from honoring a check when the check’s owner presents it for payment. Consider the following scenario: You wrote a friend a check for money, but the check got lost. You don’t want a random person to find the check and cash it. If this is the case, you might want to ask for the check to be stopped.

A stop payment order might not be honored in some circumstances, such as when sufficient information is not provided to identify the check or when the bank is not promptly notified.

For stopping the payment on a check, some banks may charge a fee. For more information on what it might cost, speak with your financial institution.

Ways To Search For Cancelled Checks

It might not be simple to obtain a cancelled check if you ultimately need one returned to you. Because banks are not required to give you physical copies of your cancelled checks, this is the case. Therefore, it’s crucial to comprehend your bank’s policies regarding how to obtain a copy. Here are two approaches to receiving a voided check.

- Using your online banking platform — You can download cancelled check images from a lot of banks. Various banks have different lengths of time that they are accessible online.

- Request a copy in branch or over the phone — You might be able to request a copy of a cancelled check from a bank teller or by calling the customer service number if it’s not possible to access it online. Typically, copies of cancelled checks must be kept by banks and credit unions for seven years. Always check with your bank or credit union to see if there are any fees associated with accessing older cancelled checks.

The End

What a cancelled check is was the topic of the article.

A cancelled check is one that has been cashed or deposited, rendering it invalid for use in subsequent transactions and preventing its use again.

Cancelled checks can be used as evidence of payment because they signify that the clearing procedure has finished.

By notifying the issuing bank, a check’s writer can also revoke it before it is cashed.

Please leave a comment if you have any queries.

I appreciate you reading.

![Best Banks In California Top 11 Picks [2022]](https://www.findmybank.com/wp-content/uploads/2022/11/Best-Banks-In-California-Top-11-Picks-2022.jpg)